The plan once you went out to college was to earn your training, see a great job just after graduation, and start their incredible job. Better, things never always go exactly how we bundle and you will immediately following faster than annually at your fantasy job, you get into the incorrect side of work cuts. It can be difficult to make closes see when looking for a great this new employment as you have debt including a vehicle commission and you can college loans.

Luckily for us you to definitely during this time, you can temporarily pause your own education loan costs unless you get back on your legs. Obtaining a student-based loan deferment or forbearance will not end desire out of accruing, but they helps to keep the financing from inside the a beneficial status.

What is Deferment?

A student loan deferment can be used to briefly postpone your own repayments. You can be eligible for an unemployment deferment consult if you’re looking for an alternate full-date occupations. If you have a sponsored financing, government entities will pay the interest on your financing during the deferment. When you have a keen unsubsidized otherwise private mortgage, youre guilty of the attention one to accrues.

Individuals may also consult a student-based loan deferment after they get back to school to finish the training or even sit in scholar school. Effective military services, Comfort Corps, and you can handicap also can qualify for deferments.

Examine each of your fund meticulously understand your options for deferment. Unpaid attract one accrues from inside the deferment period will be additional with the principal balance. That can boost your planned monthly installments in the future.

What is Forbearance?

Unless you qualify for deferment, you could get good forbearance. For individuals who meet the requirements, your loan payments would-be briefly faster or averted. Forbearance can often be provided during the 3 to 6-day increments, possibly around annually. Throughout forbearance, focus will continue to accrue to own subsidized, unsubsidized and private finance. Such as for example deferment, that will cause high costs later.

not, a great forbearance months are going to be precisely the breathing space you prefer to track down right back on your own ft and you can restart and come up with regular student mortgage payments. Constantly speak to your loan servicer quickly while you are having trouble and come up with your own education loan payments.

Are Deferment or Forbearance Suitable for Me?

If you are returning to university or destroyed your task, following asking for good deferment otherwise forbearance helps you generate finishes satisfy into a preliminary-term foundation. But contemplate, there are restrictions to help you the length of time an effective deferment or forbearance last. If you’re not qualified to receive good deferment or forbearance, or come into them too much time, understand that discover cost alternatives that you could envision, that can reduce money as well.

Deferment and you may forbearance are quick-title solutions. In products, could cause having high monthly installments because the accumulated appeal is set in your own dominant loan amount.

To own individuals that happen to be right from university, when money is rigid, it may seem tempting to put a hang on your college student loan repayments. Although not, the first thing you have to do are see your monthly costs. Figure out where you could adapt to fulfill your financial requires.

How do i Consult good Deferment otherwise Forbearance?

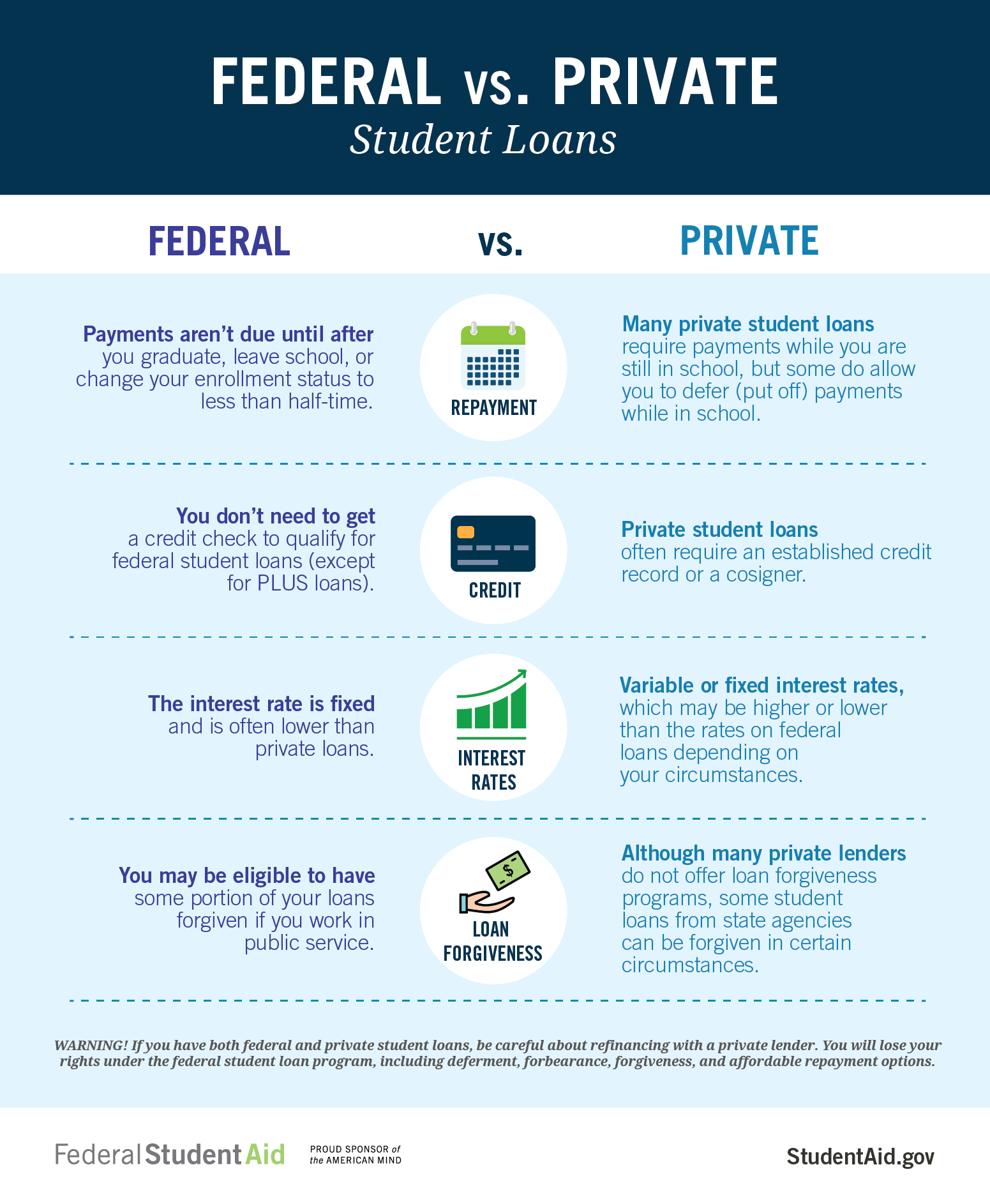

Based if or not you may have federal otherwise personal funds https://paydayloancolorado.net/twin-lakes/, the process to apply for a deferment or forbearance is other each mortgage. Deferment demands are made over the phone or in writing. Speak to your loan providers to understand its assistance. You may have to complete additional papers, based your reasons for having requesting advice about your student loan payments.

Often Deferment otherwise Forbearance Hurt My personal Credit history?

Education loan deferment and you may forbearance doesn’t damage your overall borrowing get, but they would-be noted on your own credit file. Your credit score might possibly be influenced for those who fall behind to the your instalments before you apply to own good deferment or forbearance. Always remain making money inside the application process.

There is no doubt the value of your college degree. Studies show that folks having university stages earn much more than low-college grads. So that the great things about your own college education tend to much survive the go out it could take to settle their figuratively speaking. Yet not, assistance is available while briefly struggling to build their student loan money.

NC Help Fund assist pupils get to its university desires of the connecting the new gap between your price of degree and also the number gotten from other school funding. NC Let Financing are provided by the College Foundation, Inc. (CFI), a vermont-mainly based nonprofit lender. By the borrowing away from CFI, youre support community and you will school outreach programs you to bolster the cost savings of your county out of New york.