The demand for bookkeeping services is high, and many businesses struggle to keep up with their financial reporting. This presents a significant opportunity for bookkeeping franchises to provide professional and quality services to businesses in need. Succentrix Business Advisors has created a new and comprehensive franchise model for next generation accountants, cloud-based and interconnected. Succentrix Business Advisors offers tax preparation, payroll and business support services to other entrepreneurs. In other words, it helps people to fulfill their personal and professional dreams.

Meeting Unique Franchisor Requirements

Once you’re up and running, they provide complimentary access to the American Payroll Association’s basic training so that you can become even more knowledgeable in your business. With over 100 locations across the United States, Supporting Strategies has proven to be one of the best bookkeeping franchise opportunities out there. Part of their success comes from their in-depth training and development, which includes a six-month onboarding program and continuous e-earning through their Supporting Strategies University.

Franchise Business Outlook

A bookkeeping expert will contact you during business hours to discuss your needs. By visiting our HQ location, you’ll be able to get a real sense of what Focus Bookkeeping is all about and see our success firsthand. By submitting this form, you agree to receive occasional communications from Paramount Tax via the contact information you have provided. You may opt out of receiving these communications at any time by replying « STOP » to any text message or by contacting us directly. When he’s not crunching numbers, Jason enjoys unwinding by playing guitar and piano, sharing his love for music with his wife and three kids.

Padgett Business Services: Best for Accountants

With their proven business model, you won’t have to worry about the wavering chance that comes from having a bookkeeping franchise. One of the benefits of owning a bookkeeping franchise is the flexibility to work from home. Consider if you prefer a virtual bookkeeping franchise or if you would like to work in an office setting.

Support Form

Our simple operational systems make franchise locations easy to manage upon opening. The Focus Bookkeeping model is structured to provide a highly profitable and low-investment business opportunity for franchisees, offering a strong potential ROI. Paramount Tax and Accounting, we offer our clients the freedom to run their business without the chaos of having to do it themselves.

The communications on this website are not directed by us to the residents of any of those states. This article is not intended to provide tax, legal, or investment advice, and BooksTime does not provide any services in these areas. This material has been prepared for informational purposes only, and should not be relied upon for tax, legal, or investment purposes.

Although you’re dreaming of starting a big-name franchise, sometimes things don’t work out. Our list of the top bookkeeping franchises for 2023 includes reputable franchisors who have been working in the US market and beyond for years. They are looking for new franchise units in the coming year, making this a great time to invest in this growing industry. With the right franchise, aspiring entrepreneurs can receive training and support to help them build a successful bookkeeping business of their own. You as a possible franchise partner would be treated just as our clients would with that continued support out in the field. As it is important for our clients to experience freedom in their own business, it is important to us that you would experience the freedom of running your own bookkeeping business.

These experts can provide valuable insights and strategies to improve your franchise’s financial performance. An outsourced bookkeeping service, skilled in the art of franchise finances, can provide a level of precision and efficiency that’s hard to match in-house. Not only do they swiftly process and organize your financial data across all locations, but they also deliver clear, concise reports that can guide strategic decision-making. Outsourcing your bookkeeping services can oftentimes be the lighthouse your franchise needs in the vast sea of financial intricacies.

what is construction in progress accounting: everything you need to knows offer a lucrative opportunity for individuals looking to start their own business in the financial sector. These franchises provide accounting and control services, financial resources, assistance with payroll, and tax preparation for small companies. With the bookkeeping industry worth over $4.2 billion and seeing steady growth year after year, it’s no surprise that more and more people are considering investing in bookkeeping franchises.

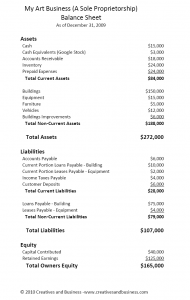

You may expedite your bookkeeping procedure and prevent frequent bookkeeping errors by adhering to the essential bookkeeping activities and best practices described in this article. The ability to control your cash flow is another crucial benefit of accounting in franchises. Because it has an impact on your capacity to pay expenses, make investments in your company, and turn a profit, it is essential to the success of your organization. You can efficiently manage your cash flow and make sure you have enough money to pay your debts by maintaining precise records of financial activities. Lastly, franchises often mean dealing with unique franchisor requirements such as royalty payments and franchise-specific reporting.

- Franchises contribute hundreds of billions of dollars of economic output each year and represent roughly 3% of the total Gross Domestic Product (GDP).

- As mentioned before, these services can scale with your business, providing you with consistent, high-quality support regardless of your franchise’s size.

- The startup costs for a bookkeeping franchise can vary widely, but they are typically much higher than the startup costs for an independent bookkeeping business.

- Navigating these requirements effectively requires a bookkeeper with a deep, specialized understanding of the franchise model.

Bookkeepers generally handle the day-to-day recording of transactions in a business. It’s their job to ensure that the books stay balanced by monitoring accounts and transactions. Outsourcing some accounting functions can save businesses time and costs while allowing them to expand their business.

ATAX Franchise was first founded in 1986 and after that began growing all over the world, especially on the East Coast. ATAX has a wide variety of full-services, national tax preparation, and business services franchises. They have an established business model and procedure for success that led ATAX to manage one of the largest self-supported tax practice businesses in the country. Investing in a bookkeeping franchise can be a lucrative opportunity for entrepreneurs interested in the financial services industry. The franchise business model provides a proven system for success, and the demand for bookkeeping services is expected to continue to grow. As a franchise partner, you will realize how lucrative the bookkeeping franchise is and with our business model, we are sure you can see how much integrity we put into a booming industry.

They have their corporate head office at Suite 8, Glenferrie Dr Robina Qld 4226 If you are interested in this franchise, you can contact them via their corporate head office address as stated above. Interface Financial https://www.business-accounting.net/ Group – IFG 50/50 offers in-house financing to cover only accounts receivable. Lack of time and an increasingly complicated tax code are leading more and more people to seek outside help in preparing their tax returns.

The company offers state-of-the-art tax preparation, free e-registration with payment of tax preparation and all banking products such as outstanding loans. And with the right preparation and marketing, you can turn your cleaning services franchise into a successful business. Let’s get into this article about franchise opportunities in the cleaning industry. EisnerAmper’s franchise specialists have decades of experience and will help clients every step of the way, getting them the best results possible. After starting with $200, 2 computers, and a fax device, the company rose to become one of the best tax course providers in the nation.

Bookkeeping is your financial dashboard; this guide will show you how to use it effectively and how to find the best bookkeeping services for franchises. We invest heavily in world-class training, the latest technology, reliable vendors and provide unmatched on-going support to ensure our partners are successful. The Book-Keeping Network was established in 1984 as a bureau service providing small businesses with a computerized financial reporting https://www.accountingcoaching.online/how-the-irs-knows-you-didn-t-report-income/ system – but without the problems and expense of owning a computer. Jackson Hewitt is a full-service tax office specializing in the computerized preparation of individual federal and state tax returns. Franchising began in 1986, the same year that the IRS introduced electronic registration. Jackson Hewit® is a tax innovator with a mission to offer hardworking clients access to simple, low-cost solutions for managing taxes and tax returns.